Building a strong credit score is a critical step toward financial independence, especially for young professionals, students, or anyone with a limited credit history. A good credit score opens doors to better loan terms, higher credit limits, and even improved job prospects in some cases. However, establishing a solid credit history from scratch can be challenging. This is where secured credit cards come in as a powerful tool to help you build or improve your credit score. Issued against a fixed deposit (FD) with a bank, secured credit cards offer a low-risk way to demonstrate financial responsibility while enjoying the benefits of a credit card.

What Is a Secured Credit Card?

A secured credit card is a type of credit card backed by a fixed deposit (FD) held with the issuing bank. Unlike traditional unsecured credit cards, which rely on your credit history and income to determine eligibility, secured credit cards are accessible even if you have no credit history or a low credit score. The fixed deposit acts as collateral, reducing the bank’s risk and making it easier for you to qualify. For example, banks like IDFC First Bank, SBI, ICICI Bank, and Bank of Baroda offer secured credit cards such as the IDFC First Wow, SBI Card Unnati, ICICI Bank Instant Platinum, and BOB Prime Credit Card.

The credit limit on a secured credit card is typically a percentage of your fixed deposit, often ranging from 80% to 100%. For instance, if you open an FD of ₹50,000, your credit limit might be ₹40,000 to ₹50,000, depending on the bank’s policy. This setup allows you to use the card for everyday purchases while the FD continues to earn interest, making it a win-win for building credit and saving money.

Why Secured Credit Cards Are Ideal for Building Credit

For young professionals or students, a limited or nonexistent credit history can make it difficult to qualify for loans, credit cards, or even rental agreements. A strong credit score, typically above 750, signals to lenders that you’re a responsible borrower. Secured credit cards are an excellent starting point for building credit because they report your payment activity to credit bureaus like CIBIL, TransUnion, and Experian. By using the card responsibly—making timely payments and keeping your credit utilization low—you can gradually improve your credit score.

Secured credit cards are particularly beneficial for individuals who are new to credit or looking to repair a poor credit score. Since the card is backed by an FD, banks are more willing to issue them to people with no credit history, making them an accessible entry point into the world of credit. Over time, consistent and responsible use of a secured credit card can help you transition to an unsecured credit card with higher limits and better rewards.

Key Features of Secured Credit Cards

Secured credit cards come with several features that make them attractive for those looking to build a strong credit score. Here are the primary benefits:

- No Credit History Required: Unlike unsecured credit cards, secured credit cards don’t require a prior credit history or a high credit score, making them ideal for beginners or those with limited credit profiles.

- Customizable Credit Limit: The credit limit is tied to the amount of your fixed deposit. You can choose the FD amount based on your financial capacity, giving you control over your credit limit.

- Credit Score Improvement: Timely repayment of your credit card balance is reported to credit bureaus, helping you build a positive credit history. This can significantly boost your credit score over time.

- Earn Interest on Your FD: While you use the credit card, the fixed deposit continues to earn interest, typically between 5% and 7% per annum, depending on the bank and FD tenure.

- Low or No Fees: Many secured credit cards, such as the SBI Card Unnati and ICICI Bank Instant Platinum, come with no joining or annual fees, making them cost-effective.

- Path to Unsecured Cards: By demonstrating responsible credit behavior, you can eventually qualify for an unsecured credit card, which often comes with higher limits and better rewards.

These features make secured credit cards a practical and low-risk option for building credit while enjoying the convenience of a credit card.

How Secured Credit Cards Help Build a Strong Credit Score

Using a secured credit card responsibly can have a direct impact on your credit score. Here’s how it works:

- Timely Payments: Paying your credit card bill on time every month is one of the most significant factors affecting your credit score. Secured credit cards provide an opportunity to establish a track record of punctual payments.

- Low Credit Utilization: Credit utilization—the ratio of your credit card balance to your credit limit—should ideally be kept below 30%. With a secured credit card, you can control your spending and maintain a low utilization rate, which positively impacts your score.

- Credit History Length: The longer you use a secured credit card responsibly, the more robust your credit history becomes. This length of credit history is another factor that credit bureaus consider.

- Diverse Credit Mix: Having a mix of credit types, such as credit cards and loans, can improve your credit score. A secured credit card adds to this mix, enhancing your credit profile.

By focusing on these aspects, you can steadily build a strong credit score, typically within 6 to 12 months of consistent use.

Popular Secured Credit Cards in India

Several banks in India offer secured credit cards with attractive features. Below are some of the most popular options:

- IDFC First Wow Credit Card

This card is ideal for frequent travelers and those seeking rewards. Issued against an FD starting at ₹5,000, it offers up to 4X reward points on every transaction and up to 6.25% annual interest on the FD. Cardholders can increase their credit limit by adding to their FD, making it a flexible option for building credit. - SBI Card Unnati

The SBI Card Unnati is issued against an FD of ₹25,000 or more. It has no annual fee for the first four years and offers reward points on purchases. This card is a great choice for those looking for a cost-effective way to build credit. - ICICI Bank Instant Platinum Credit Card

Available against an FD of ₹50,000 or higher, this card comes with no joining or annual fees. It also offers reward points and discounts on dining and fuel, making it a practical option for everyday use. - Bank of Baroda Prime Credit Card

Issued against an FD of ₹15,000 or more, this card requires no income proof and offers a lifetime-free option with reward points on transactions. It’s a straightforward choice for those starting their credit journey.

These cards provide a range of benefits, from reward points to interest earnings, making them appealing for anyone looking to build a strong credit score.

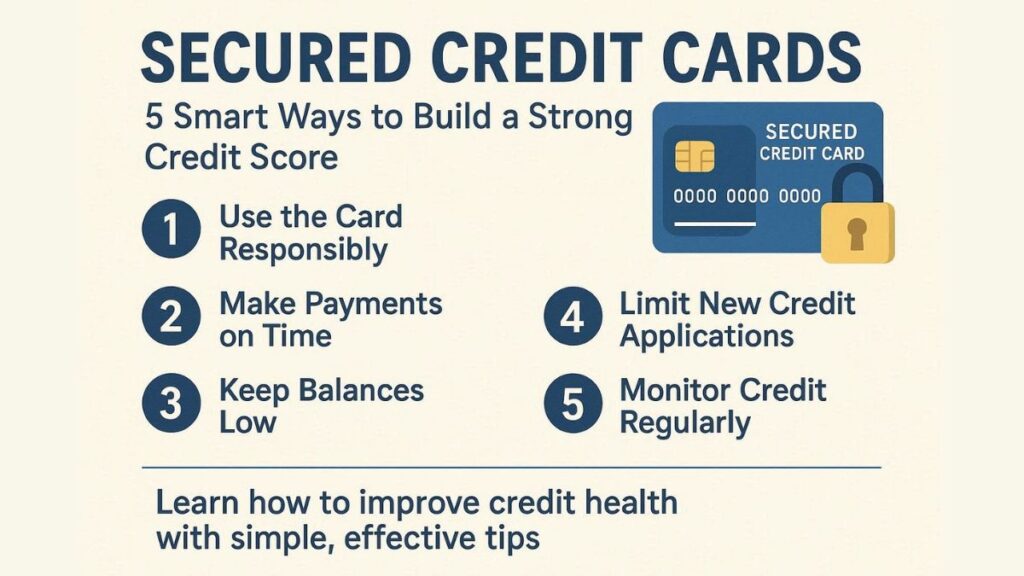

Tips for Using a Secured Credit Card Effectively

To maximize the benefits of a secured credit card and build a strong credit score, follow these tips:

- Pay Your Bills on Time: Set reminders or automate payments to ensure you never miss a due date. Late payments can negatively impact your credit score.

- Keep Credit Utilization Low: Aim to use no more than 30% of your credit limit at any time. For example, if your limit is ₹50,000, try to keep your balance below ₹15,000.

- Monitor Your Credit Score: Regularly check your credit score through platforms like CIBIL or Experian to track your progress and ensure accuracy.

- Use the Card Regularly: Make small, manageable purchases and pay them off in full each month to demonstrate consistent credit activity.

- Avoid Closing the Card Prematurely: Keeping the card active for at least 6–12 months helps establish a longer credit history.

By following these practices, you can leverage a secured credit card to build a strong credit score efficiently.

Who Should Consider a Secured Credit Card?

Secured credit cards are ideal for:

- Young Professionals and Students: Those with no credit history can use secured credit cards to start building a positive credit profile.

- Individuals with Low Credit Scores: If your credit score is below 750, a secured credit card can help you improve it over time.

- People Seeking Financial Discipline: Secured credit cards encourage responsible spending since the credit limit is tied to your FD.

- Travelers and Shoppers: Many secured credit cards, like the IDFC First Wow, offer rewards and benefits for travel and retail purchases.

If you fall into any of these categories, a secured credit card could be a smart choice to establish or enhance your creditworthiness.

Conclusion

Secured credit cards are a powerful tool for building a strong credit score, especially for those with limited or no credit history. By requiring a fixed deposit as collateral, these cards provide an accessible way to demonstrate financial responsibility while enjoying the benefits of a credit card.

With options like the IDFC First Wow, SBI Card Unnati, ICICI Bank Instant Platinum, and Bank of Baroda Prime Credit Card, you can choose a card that suits your needs and financial goals. By making timely payments, keeping credit utilization low, and using the card responsibly, you can steadily improve your credit score and pave the way for better financial opportunities. Start your credit-building journey today with a secured credit card and take control of your financial future.

FAQs for How Secured Credit Cards Can Help You

1. What is a secured credit card, and how does it work?

A secured credit card is issued against a fixed deposit (FD) with the bank. Your FD acts as collateral, and the bank sets your credit limit based on the deposit amount, typically 80–100% of its value.

2. Who should apply for a secured credit card?

Secured credit cards are ideal for beginners with no credit history, students, young professionals, or individuals with low credit scores looking to rebuild their credit profile.

3. How does a secured credit card help build a credit score?

Timely payments and low credit utilization are reported to credit bureaus like CIBIL and Experian, helping you establish a positive credit history and gradually improve your credit score.

4. What is the minimum fixed deposit amount required for a secured credit card?

It varies by bank. For example, SBI Card Unnati requires a minimum FD of ₹25,000, while IDFC First Wow offers cards against FDs as low as ₹5,000.

5. Can I earn interest on my fixed deposit while using the secured credit card?

Yes. Your FD continues to earn interest, typically between 5% and 7% annually, while you use the credit card for transactions.

6. Do secured credit cards have annual or joining fees?

Many secured credit cards, such as SBI Card Unnati and ICICI Bank Instant Platinum, have no annual or joining fees, making them cost-effective for credit building.

7. How long should I use a secured credit card before applying for an unsecured one?

Most banks consider 6–12 months of responsible usage—timely payments and low credit utilization—before offering an unsecured credit card with better benefits.

8. What happens if I default on a secured credit card?

If you fail to pay your dues, the bank can recover the outstanding amount from your fixed deposit. This may also negatively impact your credit score.

9. Can I increase my credit limit on a secured credit card?

Yes. You can increase your credit limit by adding more funds to your fixed deposit, as the limit depends on the FD amount.

10. Is it possible to close a secured credit card and get my FD back?

Yes. You can close the card anytime after clearing all dues. The bank will release your fixed deposit amount along with the accrued interest.

Leave a Reply