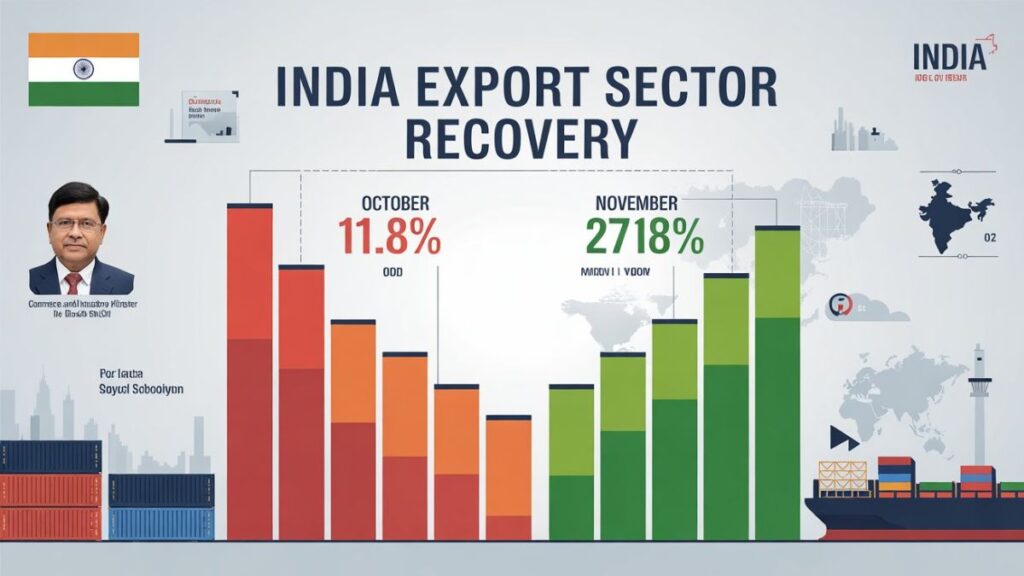

India’s export sector appears to be back on track after a difficult October, with Commerce and Industry Minister Piyush Goyal confirming that merchandise exports recorded healthy growth in November. This rebound comes after a sharp 11.8% fall in exports in October, driven partly by higher US tariffs and global economic turbulence.

While the exact numbers remain under wraps, the commerce ministry is set to release the official November trade data on December 15.

Exports Recover: “November Has Gone Up More Than October Went Down.”

Speaking to reporters, Goyal highlighted that India’s export performance is stabilising despite global uncertainty:

- October merchandise exports fell sharply, but

- November exports rose by an even greater margin, resulting in overall positive growth when combining both months.

He emphasised that India continues to strengthen trade ties globally and hinted at upcoming announcements on new trade partnerships.

India is currently negotiating multiple Free Trade Agreements (FTAs) with partners such as:

- the US

- European Union

- Oman

- New Zealand

- Chile

- Peru

📈 Economic Indicators Remain Strong Despite Currency Volatility

Goyal also touched upon India’s broader economic health, asserting that the country remains resilient:

- GDP growth at 8.2% in Q2, surpassing expectations

- Record-low inflation in recent months

- Robust foreign exchange reserves

- Strong capital inflows, steady infrastructure investments, and rising consumer demand

However, these positive signals were overshadowed by dramatic currency movement.

💸 Rupee Breaches 90 Per Dollar for First Time — Sparks Meme Fest on Social Media

The Indian rupee made headlines after sliding past the 90-per-dollar mark, hitting a historic low:

- Closed at 90.21, after touching 90.30 intraday

- Pressured by:

✔ Sustained foreign fund outflows

✔ Rising global crude oil prices

✔ Uncertainty around the India–US trade deal - Traders noted lack of visible RBI intervention, which amplified volatility

The sharp fall triggered a wave of humour, sarcasm, and political digs online.

Social Media Reacts: From Sarcasm to Satire

As the rupee hit its weakest-ever level, Indians on social platforms didn’t hold back:

- “If Nehru had accepted Pound as India’s currency in 1947… saari galti Nehru ki hai.”

— Users mock familiar political blame games. - “Rupee ka naam badal kar Dollar kar do—phir 1 rupee = 90 dollar ho jayega.”

— Jokes about renaming currencies went viral. - References resurfaced to Anand Mahindra’s 2013 tweet describing the rupee as “skydiving without a parachute.”

- One user joked:

“Rupee is the real anti-national—how can it fall so low?” - Many also revived Finance Minister Nirmala Sitharaman’s 2022 clip claiming the rupee performed better than other emerging market currencies.

📊 Trade Snapshot (April–October)

Despite recent volatility:

- Exports rose slightly by 0.63% to USD 254.25 billion

- Imports increased 6.37% to USD 451.08 billion

- Trade deficit touched a record USD 41.68 billion in October due to a jump in gold imports

India’s Trade, Rupee Movement, and Dollar to INR Trends: Conclusion

India’s economy remains on a strong footing with higher Q2 growth, improving export numbers for November, and optimism around upcoming FTAs. But the historic slide of the rupee has sparked intense scrutiny—as well as humour—across the country.

As markets await the official November trade data on December 15, both investors and policymakers will be watching closely to see if the recovery in exports can offset currency pressures and global uncertainties.

Note: All information and images used in this content are sourced from Google. They are used here for informational and illustrative purposes only.

FAQs About India’s Trade, Rupee Movement, and Dollar to INR Trends

1. Why did India’s exports rise in November despite the Dollar to INR volatility?

India’s merchandise exports rebounded strongly in November because global demand stabilised and several sectors improved after October’s temporary decline. Despite Dollar to INR fluctuations, Commerce Minister Piyush Goyal confirmed that November exports rose more than they fell in October, resulting in net growth across the two months combined.

2. How is the government addressing the impact of Dollar to INR fluctuations on trade?

The government is actively pursuing new Free Trade Agreements (FTAs) with major partners such as the US, EU, Oman, Peru, New Zealand, and Chile. These agreements aim to reduce trade barriers and strengthen India’s export competitiveness, helping offset any short-term challenges caused by Dollar to INR movements.

3. Why did the Dollar to INR exchange rate hit a record high of 90 recently?

The Dollar to INR rate touched 90 due to several factors: sustained foreign fund outflows, rising global crude oil prices, and uncertainty around the India–US trade deal. Traders also noted the absence of visible RBI intervention, which added pressure to the rupee and led to its historic low.

4. Is India’s economy still strong despite the sharp Dollar to INR depreciation?

Yes. Minister Piyush Goyal highlighted that India’s economy remains robust. GDP growth for Q2 stood at 8.2 percent, inflation recently fell to some of its lowest levels, and foreign exchange reserves stay strong. Investments in infrastructure, capital inflows, and consumer spending continue to support economic momentum despite Dollar to INR fluctuations.

5. How do Dollar to INR swings affect India’s export competitiveness?

A weaker rupee can make Indian goods cheaper and more competitive in global markets, which sometimes boosts exports. Although Dollar to INR swings create short-term uncertainty, India’s export performance in November shows resilience even during volatile periods.

6. What trade trends emerged between April and October, and how did Dollar to INR changes influence them?

Between April and October, India’s exports grew marginally by 0.63 percent to USD 254.25 billion, while imports rose 6.37 percent to USD 451.08 billion. Though Dollar to INR shifts added pressure on import costs—especially for gold—the overall trade sector remained stable.

7. Are Dollar to INR fluctuations affecting upcoming Free Trade Agreements?

Dollar to INR volatility does not directly affect FTA negotiations. India continues to push for stronger global trade relations, and according to Piyush Goyal, more successful trade announcements are expected soon. These agreements aim to enhance long-term economic stability regardless of short-term currency movements.

8. Why is the Dollar to INR trend often a trigger for political and social media reactions?

The Dollar to INR rate is closely watched by businesses, consumers, and investors. When the rupee falls sharply—as it did when it breached 90—social media users respond with humour, political commentary, and memes. Currency performance often becomes a symbol of broader economic sentiment, which fuels online discussions.

9. Will the Dollar to INR rate stabilise as exports improve?

Export growth can help stabilise the economy, but the Dollar to INR rate also depends on global factors such as crude prices, foreign investment flows, and international trade relations. The rebound in November exports is a positive sign, but long-term stability will require continued policy support and favourable global conditions.

10. What should businesses keep in mind about future Dollar to INR changes?

Businesses should monitor global economic trends, India–US trade developments, and commodity prices. While Dollar to INR volatility may affect import costs, India’s strong economic indicators—rising exports, solid GDP growth, and healthy forex reserves—offer confidence for long-term planning.

Leave a Reply