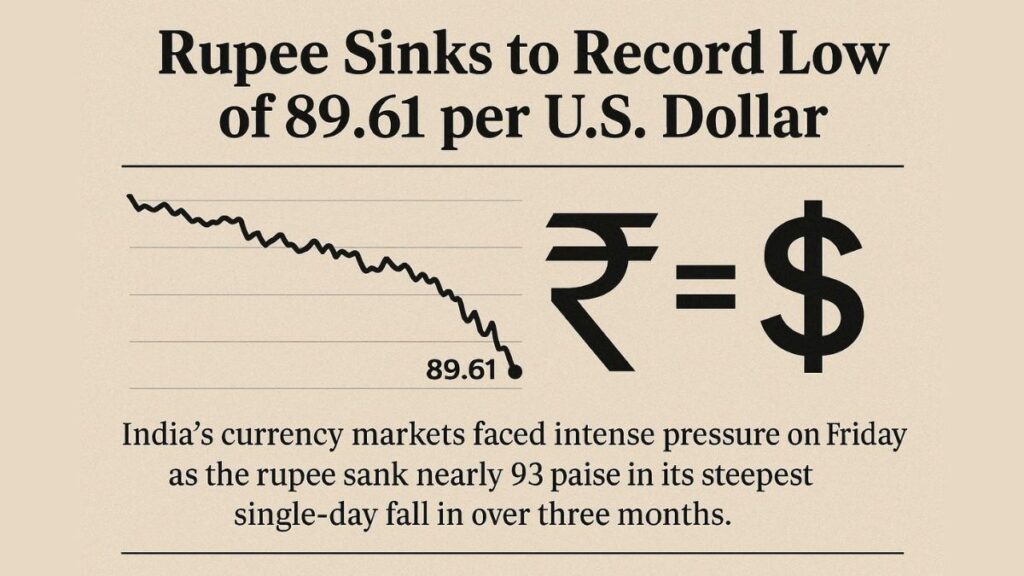

India’s currency markets faced intense pressure on Friday as the rupee sank to an all-time low of 89.61 per US dollar, dragged down by persistent foreign portfolio outflows, uncertainty surrounding a potential US-India trade agreement, and signs that the Reserve Bank of India (RBI) may be reducing its intervention at key support levels.

The rupee’s nearly 93-paise single-day fall marked its steepest slide in more than three months, pushing the currency beyond the 89-per-dollar threshold for the first time. The drop takes the rupee past its previous lifetime low of 88.80, which was tested twice—first in late September and again earlier this month.

90 Mark Now in Sight as Market Sentiment Remains Fragile

Analysts warn the rupee could soon test the psychologically critical 90 level if trade negotiations between Washington and New Delhi remain unresolved. This comes despite India’s strong macroeconomic backdrop, including robust corporate earnings and stock markets hovering near record highs.

US Tariffs Hit India’s Trade Balance

Since steep US tariffs on Indian exports took effect in late August, the rupee has struggled to recover. The tariffs have disrupted trade flows, driving India’s merchandise trade deficit to a record high last month. Exports to the US contracted 9% year-on-year, highlighting the mounting pressure on bilateral trade relations.

$16.5 Billion in FPI Outflows Adds Fuel to the Fire

Foreign investors have increasingly adopted a risk-off stance, pulling $16.5 billion out of Indian equities so far this year. This makes India one of the hardest hit among emerging markets in terms of portfolio withdrawals—an exodus that has significantly amplified downward pressure on the rupee.

RBI Seen Scaling Back Its Defence of the Currency

A Reuters report indicated that traders believe the RBI, which had been actively defending the 88.80 level earlier, appeared less aggressive this week and may have intervened only near 89.50 on Friday.

“USD/INR broke decisively above 89—a level many believed the RBI would defend. Once that perception faded, massive short-covering across onshore and offshore markets accelerated the rally,” said Anindya Banerjee, Head of Research (Currency, Commodity & Interest Rate Derivatives) at Kotak Securities.

Banerjee added that a firm US Dollar Index, global risk-off sentiment, and uncertainty around the trade deal continue to tilt the bias upward, with traders eyeing the 88.7–90.3 range in the near term.

RBI Governor Reiterates: No Target for Rupee

RBI Governor Sanjay Malhotra reiterated on Thursday that the central bank does not set a specific exchange-rate target and that currency movements remain driven by market forces.

Rupee Among Asia’s Weakest This Year

With a 4.5% year-to-date decline, the rupee now ranks among the poorest-performing Asian currencies in 2024, reflecting both external pressures and sustained capital outflows.

Note: All information and images used in this content are sourced from Google. They are used here for informational and illustrative purposes only.

Frequently Asked Questions: Rupee Crashes to Record Low

1. Why did the Rupee Crashes to Record Low event occur this week?

The Rupee Crashes to Record Low due to a combination of heavy foreign portfolio outflows, uncertainty over a potential US-India trade deal, and reduced intervention from the Reserve Bank of India at crucial support levels. These pressures intensified market volatility and pushed the rupee below its previous lifetime low.

2. How are US tariffs linked to the Rupee Crashes to Record Low?

US tariffs on Indian exports, imposed in late August, disrupted trade flows and widened India’s merchandise trade deficit to a record high. With exports to the US falling 9% year-on-year, the strain on trade relations contributed significantly to the Rupee Crashes to Record Low scenario.

3. Did foreign investors play a role in the Rupee Crashes to Record Low?

Yes. Foreign investors have withdrawn $16.5 billion from Indian equities this year, making India one of the worst-hit emerging markets for FPI outflows. This risk-off sentiment added strong downward pressure, accelerating the Rupee Crashes to Record Low movement.

4. Is the RBI defending the currency after the Rupee Crashes to Record Low?

Traders suggest the RBI has scaled back its aggressive defence of specific levels. While the central bank may still intervene occasionally, it has emphasized that it does not target any fixed exchange rate, even amid the Rupee Crashes to Record Low situation.

5. Could the rupee fall further after the Rupee Crashes to Record Low?

Analysts believe the rupee may test the psychologically important 90 level if US-India trade negotiations remain unresolved. Stronger global risk-off sentiment and a firm US Dollar Index could keep upward pressure on USD/INR following the Rupee Crashes to Record Low.

6. How is India’s economy performing despite the Rupee Crashes to Record Low?

Surprisingly, India’s broader economic fundamentals remain resilient. Equity markets hover near record highs, corporate earnings are strong, and domestic growth remains steady. These strengths help cushion the overall impact of the Rupee Crashes to Record Low event.

7. What range are traders watching after the Rupee Crashes to Record Low?

Market experts expect the USD/INR to move within a broad 88.7–90.3 range in the near term. This guidance reflects ongoing volatility after the Rupee Crashes to Record Low and gives importers and exporters a framework for planning their currency exposure.

8. How does the Rupee Crashes to Record Low compare with other Asian currencies?

The rupee is among the weakest-performing Asian currencies, with a 4.5% YTD decline. While external pressures vary across the region, India has faced heavier portfolio outflows, which amplified the Rupee Crashes to Record Low trend.

Leave a Reply