Introduction of Studds Accessories IPO

Strong Momentum: Why Studds Accessories IPO (₹557-585) with ₹69 GMP Deserves Your Attention

If you’re searching for an IPO with solid market traction and good fundamentals, the Studds Accessories IPO is worth a look. With a healthy grey-market premium (GMP) of about ₹69 and positive subscription figures by Day 3, this offering is attracting investor interest. In this review, we will go over the key details, subscription status, GMP trends, and whether you should apply.

Key IPO Details

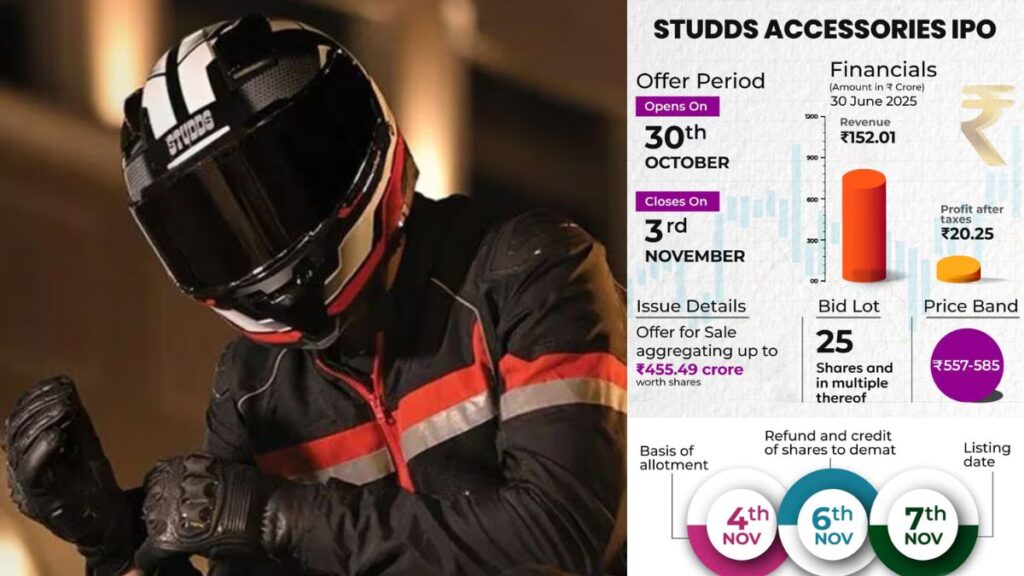

Studds Accessories Limited’s IPO is open for subscription from 30 October 2025 to 3 November 2025.

The price band is set at ₹557 to ₹585 per share.

The issue size is approximately ₹455.49 crore, and it is completely an Offer-for-Sale (OFS), meaning existing shareholders are selling shares; the company will not receive any new capital.

Minimum lot size: 25 shares; at the upper band, you’ll invest about ₹14,625 (₹585 × 25).

Expected listing date: 7 November 2025.

Subscription & GMP (Grey Market Premium) Highlights

On Day 1, the IPO was subscribed about 1.54 times overall.

On Day 2, subscriptions jumped to around 5.08 times overall.

Grey Market Premium (GMP) has risen:

Day 1 GMP was around ₹55.

Later, it increased to roughly ₹63.

Most recently, GMP reached about ₹67-₹69, suggesting a potential listing price of around ₹652 based on the upper band.

This increase in GMP indicates solid demand and positive investor sentiment.

Company & Industry Strengths

Studds Accessories is one of India’s largest two-wheeler helmet manufacturers and reportedly the world’s largest by volume for a recent year.

The company exports to over 70 countries, which expands its reach beyond the domestic market.

Key OEM relationships and increasing safety regulations in the two-wheeler segment contribute to growth.

The business seems liquid and financially stable. For example, profit after tax for the recent year was about ₹70 crore, with cash around ₹63 crore.

Potential Risks & Considerations

Since this is purely an OFS, and no new shares are issued, the company won’t receive any funds for expansion. Investors are buying existing shares, which limits the growth potential.

The QIB (Qualified Institutional Buyers) portion appears weak early in subscriptions. Low QIB uptake may suggest higher risk or more speculation from retail investors.

While there are growth opportunities, some metrics, like EBITDA, may still be below pre-COVID levels.

GMP is a speculative indicator and does not guarantee listing performance, as grey market prices can vary.

Should You Apply? My Take

Given the data, including a strong GMP (~₹69), solid subscriptions so far, and a company with clear industry leadership, applying for the Studds Accessories IPO is reasonable, especially if you’re looking for short-term gains.

However, if your goal is long-term investment backed by new growth capital, keep in mind that this is an OFS, and growth plans may be limited.

If I were advising:

Short-term listing play: Yes, apply—the GMP suggests a likely listing above the issue price, and investors are viewing it positively.

Medium/long-term investor: It’s a fair option, but ensure you trust in the company’s continued growth and keep an eye on all risk factors (competition, margin pressures, reliance on OEMs) before investing significantly.

Conclusion

The Studds Accessories IPO is launching with strong momentum, featuring a well-priced band (₹557-585), rising GMP (~₹69), and a company with a global presence in the two-wheeler accessories market. For retail investors seeking potential listing gains, this seems like a good opportunity. Just remember the OFS nature of the offering and think about how long you plan to hold.

Keep in mind that GMP is just a guide and market conditions can shift. Always match your investment decisions with your time frame and risk tolerance.

Final Thoughts

The Studds Accessories IPO combines strong fundamentals, a growing industry, and robust investor demand. With a GMP of ₹69, oversubscription momentum, and a reputed market presence, it stands out as a potential winner for short-term listing gains and moderate-risk investors. Always evaluate your risk appetite and consult a financial expert before investing.

Disclaimer: This blog post is for information only and is not a financial recommendation. Investors should consult certified financial advisors before making investment choices.

Frequently Asked Questions (FAQs) on Studds Accessories IPO

1. What is the price band for the Studds Accessories IPO?

The Studds Accessories IPO price band has been fixed between ₹557 and ₹585 per equity share. This range provides a fair valuation based on the company’s market position as one of the world’s largest helmet manufacturers.

2. What are the opening and closing dates of the Studds Accessories IPO?

The Studds Accessories IPO opened for subscription on October 30, 2025, and will close on November 3, 2025. Investors can apply within this window through their brokers or online trading platforms before 5 PM on the last day.

3. How much is the Studds Accessories IPO size and what type of issue is it?

The Studds Accessories IPO issue size is around ₹455.49 crore, and it is a complete Offer-for-Sale (OFS). This means no fresh equity will be issued, and the company will not receive direct funds. Instead, existing shareholders are offering their shares to the public.

4. What is the minimum investment required for the Studds Accessories IPO?

Investors need to apply for a minimum lot size of 25 shares, meaning the minimum investment at the upper price band of ₹585 is ₹14,625 (₹585 × 25).

5. What is the latest Studds Accessories IPO GMP today?

As per the latest grey market trends, the Studds Accessories IPO GMP (Grey Market Premium) is around ₹69, indicating strong investor enthusiasm. This suggests a potential listing price of approximately ₹652 per share, based on the upper price band.

6. How has the subscription status of Studds Accessories IPO performed so far?

The Studds Accessories IPO subscription numbers have shown strong demand:

- Day 1: 1.54 times overall

- Day 2: 5.08 times overall

- Day 3 (till afternoon): over 13.95 times overall

This strong subscription shows wide investor interest from both retail and institutional segments.

7. What are the main strengths of Studds Accessories as a company?

The Studds Accessories IPO highlights a company with impressive credentials:

- India’s largest and world’s biggest two-wheeler helmet maker by volume.

- Exports to over 70 countries, establishing a global footprint.

- Strong partnerships with OEMs (Original Equipment Manufacturers).

- Backed by rising safety regulations driving helmet demand.

- Stable profitability, with ₹70 crore PAT and strong liquidity.

8. Are there any risks to consider before applying for the Studds Accessories IPO?

Yes, while the fundamentals are positive, investors should note that:

- The IPO is a pure OFS, so no fresh capital will go to the company.

- The QIB (Qualified Institutional Buyer) response is moderate compared to retail demand.

- Earnings and EBITDA are improving but still below pre-COVID levels.

- The GMP is a speculative measure and not a guaranteed indicator of listing performance.

9. Should I apply for the Studds Accessories IPO for short-term or long-term gains?

If you’re seeking short-term listing gains, the Studds Accessories IPO looks attractive because of its strong GMP and oversubscription trends. For long-term investors, the company’s leadership and brand strength are positives, but as it’s an OFS, growth funding may be limited in the immediate term.

10. What is the expected listing date for the Studds Accessories IPO?

The Studds Accessories IPO listing date is expected to be November 7, 2025, on both BSE and NSE. Given the strong GMP, many analysts expect a positive debut above the issue price.

11. How can I check the allotment status of the Studds Accessories IPO?

Investors can check the Studds Accessories IPO allotment status on the official websites of BSE, NSE, or through the registrar KFin Technologies once the allotment is finalized.

12. What do analysts and brokerages say about the Studds Accessories IPO?

Brokerages such as Canara Bank Securities have assigned a ‘Subscribe’ rating to the Studds Accessories IPO, citing strong industry leadership, export growth, and improving margins. Analysts believe the reasonable pricing and growth prospects make it a promising opportunity.

Leave a Reply