Gold and silver have entered uncharted territory, setting fresh all-time highs as investors increasingly treat precious metals not as short-term trades, but as strategic monetary shields. According to a new outlook from Goldman Sachs, gold prices could climb as high as $4,900 per ounce by December 2026, driven by sustained geopolitical instability and evolving global monetary dynamics.

Geopolitical Shocks Are Reshaping Market Behavior

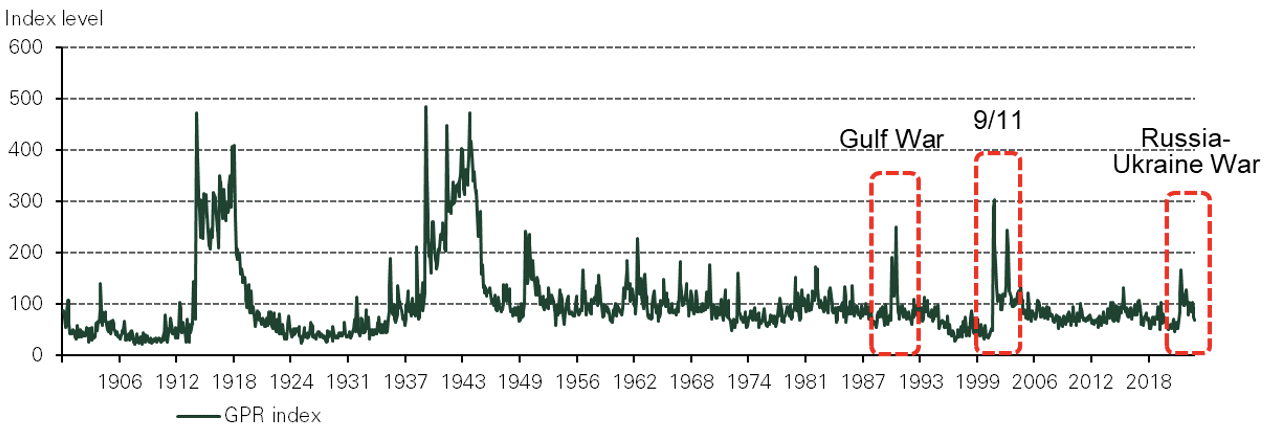

The latest rally was sparked by a sharp escalation in global security risks. Recent U.S. enforcement actions targeting oil shipments connected to Venezuela sent a clear warning to markets: geopolitical enforcement risk is intensifying. This followed a direct order from Donald Trump calling for a full blockade of sanctioned tankers entering or leaving Venezuela.

For investors, the implications were immediate. Rising uncertainty around global energy routes and trade corridors has increased fears of miscalculation, pushing capital toward assets that are insulated from political pressure, sanctions, and counterparty risk. Gold and silver, which exist outside the traditional financial system, have benefited directly from this shift.

Middle East Tensions Add to Persistent Risk Premium

The sense of instability was further amplified by military developments in the Middle East. U.S. forces, supported by Jordan, carried out strikes on more than seventy targets in Syria following an attack that killed three American personnel.

While such actions do not disrupt precious metals supply chains, they reinforce a growing belief among investors that geopolitical stress is no longer temporary. Instead, it is becoming a constant feature of the global investment landscape—one that consistently favors hard assets over paper claims.

Gold and Silver Now Trade Like Monetary Assets

Market pricing reflects this structural shift. Spot gold recently jumped about 1.5% to roughly $4,405 per ounce, briefly touching a record near $4,410. Silver surged nearly 3% to around $69 per ounce, approaching the $70 mark after hitting a new intraday high.

Crucially, these gains were not fueled solely by speculative momentum. Longer-term investors, including institutions and reserve managers, have been steadily increasing exposure to precious metals. Their motivation is rooted in policy uncertainty, sanctions risk, and the desire for assets that do not depend on stable political relationships.

Monetary Policy and Central Banks Add Fuel

Beyond geopolitics, monetary conditions continue to strengthen the case for gold. Expectations of further interest rate cuts from the Federal Reserve reduce the opportunity cost of holding non-yielding assets like bullion.

At the same time, central banks around the world are maintaining elevated levels of gold purchases. This trend reflects a broader effort to diversify away from traditional reserve currencies and reduce exposure to geopolitical and financial sanctions. As a result, gold demand is becoming less sensitive to short-term price swings and more anchored in long-term strategic allocation.

What Investors Should Watch Next

Looking ahead, two forces will likely determine the trajectory of precious metals:

- Base case: Ongoing geopolitical tension combined with gradual monetary easing supports consolidation at higher levels and continued long-term upside for gold and silver.

- Risk scenario: A rapid easing of global tensions alongside reduced expectations for rate cuts could trigger short-term pullbacks.

Even in the bearish scenario, the underlying demand shift suggests that price dips are more likely to attract buyers than signal a lasting reversal.

Bottom Line

Gold and silver are no longer reacting solely to inflation or currency moves. They are increasingly functioning as alternative monetary assets in a world marked by persistent geopolitical risk and policy uncertainty. If current trends hold, forecasts like Goldman Sachs’ $4,900 gold target may prove less bold than they sound today—making precious metals a central pillar of long-term portfolio strategy rather than a tactical hedge.

Note: All information and images used in this content are sourced from Google. They are used here for informational and illustrative purposes only.

Frequently Asked Questions About Gold Prices Today

1. Why are Gold Prices Today reaching record highs across global markets?

Gold Prices Today are surging to historic levels because investors are responding to sustained geopolitical uncertainty and shifting monetary conditions. Rising enforcement risks around global energy routes, escalating conflicts in key regions, and concerns over policy unpredictability are driving capital toward gold, which is viewed as a monetary asset that does not rely on governments, currencies, or trade systems to retain value.

2. How does geopolitical tension influence Gold Prices Today so strongly?

Geopolitical instability increases the probability of supply disruptions, sanctions, and financial system stress. Gold Prices Today benefit because gold carries no counterparty risk and remains outside political control. Events involving Venezuela, Middle Eastern military developments, and heightened global enforcement actions reinforce gold’s role as a strategic hedge rather than a speculative trade.

3. Why do analysts believe Gold Prices Today could rise to $4,900 by 2026?

Major financial institutions such as Goldman Sachs forecast higher long-term prices because demand for gold is becoming structural. Central banks are increasing gold reserves, investors are reallocating toward hard assets, and monetary easing is expected to continue. These forces support sustained upside rather than short-lived price spikes.

4. What role does monetary policy play in shaping Gold Prices Today?

Monetary policy is a major driver of Gold Prices Today. Expectations of interest rate cuts from the Federal Reserve lower the opportunity cost of holding non-yielding assets like gold. As real yields decline, gold becomes more attractive as both a store of value and a portfolio stabilizer.

5. Are Gold Prices Today rising because of speculation or long-term investment demand?

Unlike previous rallies, Gold Prices Today are being supported by long-term investors rather than short-term traders. Pension funds, sovereign institutions, and central banks are steadily accumulating gold as part of strategic asset allocation, reflecting a shift away from reliance on traditional reserve currencies and financial instruments.

6. How are central banks affecting Gold Prices Today?

Central banks are playing a critical role in supporting Gold Prices Today by maintaining elevated gold purchases. This trend reflects growing concern about sanctions risk, reserve diversification, and financial sovereignty. Central-bank buying creates a strong and stable demand base that is less sensitive to short-term price volatility.

7. Could Gold Prices Today experience a pullback despite the bullish outlook?

Yes, short-term corrections are possible if geopolitical tensions ease quickly or if interest rate cut expectations are revised lower. However, the broader transformation of gold into a strategic monetary asset suggests that any pullbacks in Gold Prices Today are likely to attract buyers rather than signal a long-term reversal.

8. Why are Gold Prices Today increasingly compared to alternative currencies?

Gold Prices Today reflect gold’s growing role as an alternative monetary asset rather than a traditional commodity. In an environment of persistent geopolitical stress, expanding sanctions regimes, and currency uncertainty, gold is valued for its neutrality, liquidity, and independence from financial systems—qualities typically associated with reserve currencies.

Click Here For More Information: https://www.facebook.com/profile.php?id=61578709299739