Summary

Introduction about Nifty 50 & Sensex Today:

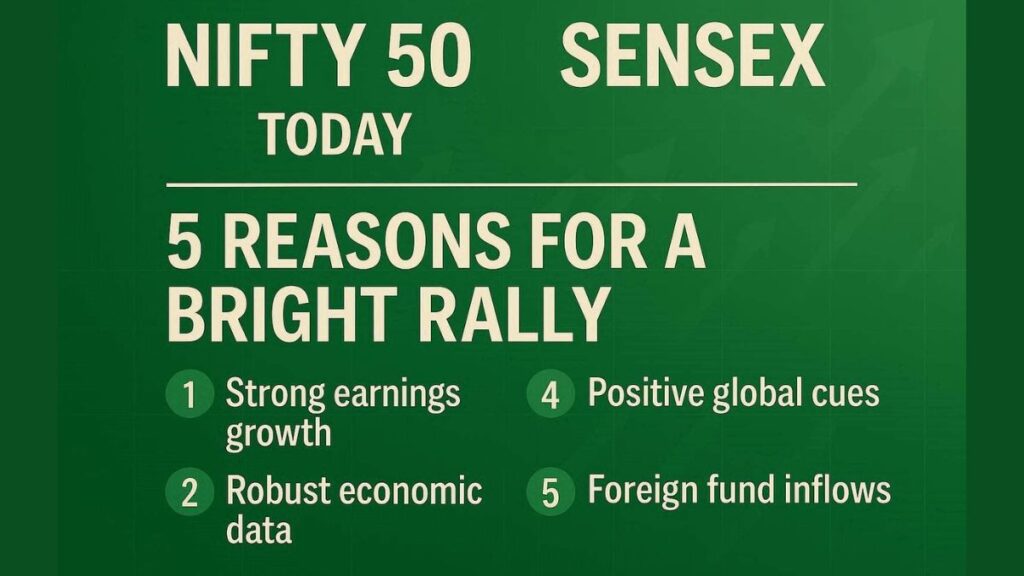

What’s up with the Indian Stock Market on October 20, Before Diwali 2025? As India gets ready for the holidays, the market’s feeling good. The Nifty 50 and Sensex are expected to kick off higher on October 20, 2025, fueled by good vibes from around the world and solid action at home. The Gift Nifty is hinting at a positive start, trading near 25,965, which is 207 points above the Nifty futures’ last close.

This upswing is happening right before Diwali 2025, with the market keeping its win streak going and investors feeling confident. On Friday, the Sensex jumped 484.53 points (0.58%) to 83,952.19, and the Nifty 50 closed 124.55 points (0.49%) up at 25,709.85 — making it three winning sessions in a row.

Nifty 50 and Sensex Outlook: Holiday Momentum Ahead

Experts think the Indian stock market will start strong, backed by great earnings reports, foreign money coming back in, and positive signs from trading charts. The Sensex is still making higher highs and higher lows on both daily and shorter-term charts, which confirms a solid short-term climb.

For the week, the Sensex shot up 1.76%, making it three weeks of gains straight and creating a long, positive trend on the weekly charts. The folks at Kotak Securities pointed out that while things look good in the short term, some folks might want to cash in at higher prices. They see support at 83,000 – 82,400, with prices possibly hitting resistance near 84,400 and 85,300.

Sudeep Shah from SBI Securities thinks the Sensex might keep heading up, maybe hitting 84,600 and 85,000, thanks to good earnings and stable situations around the world.

Nifty 50 Today: Key Numbers and Guesses

The Nifty 50 has been forming positive candles in a row, which means people are still buying. For the week, it went up 1.68%, its third winning week in a row. Nagaraj Shetti from HDFC Securities said that the Nifty has broken out above the important resistance area of 25,400–25,500, opening the door for further gains.

The next price goal is around 26,200, with support kicking in at 25,500. Trading signals like MACD and RSI (around 70) are showing strong buying, especially in big players like Reliance Industries, HDFC Bank, and Infosys.

Puneet Singhania from Master Trust Group said that resistance is expected near 26,000, and if it breaks through, the Nifty could go toward 26,300 or even higher. He mentioned that the 25,400–25,500 area is a good base for continued strength.

Sudeep Shah also noted that the Symmetrical Triangle pattern puts the target at around 26,730 in the medium term, while 25,350–25,400 will be key support areas, helping to soften any short-term bumps.

Bank Nifty Prediction: Bulls are Totally in Control

The Bank Nifty also finished the week with good gains, going up 290.80 points (0.51%) to 57,713.35. It’s been on a roll for three weeks straight, backed by steady buying in major bank stocks and trading above its 21-day and 55-day EMAs — a strong positive sign.

Trading experts from SAMCO Securities and Asit C. Mehta Investment Intermediates confirmed the pattern of higher highs and higher lows, with the RSI above 74 and MACD looking good too.

Support is near 57,300 – 57,400, and getting above 58,200–58,350 could lead to 59,000 soon. Buying on dips is still the go-to move for traders, especially with the holiday season boosting spending and investor optimism.

Global Indices & Commodity Market Breakdown: Another Perspective

| Market Segment | Performance Overview | Key Drivers | Analyst View | Impact on Indian Market |

|---|---|---|---|---|

| Nifty 50 & Sensex Today – Global Market Influence | Nifty 50 & Sensex Today reflect optimism as global equities trade higher across Asia and the West. | Positive macroeconomic data from Asia and stable inflation numbers in the US. | Analysts believe global growth stability supports emerging markets like India. | Strengthens investor confidence, encouraging FII inflows and continued domestic rally. |

| Nifty 50 & Sensex Today – Japan’s Nikkei 225 | Nifty 50 & Sensex Today mirror Japan’s Nikkei, which surged nearly 3%. | Political clarity and economic reforms in Japan lifted market sentiment. | Nikkei’s rise shows renewed investor risk appetite across Asia. | Inspires confidence in Indian equities as Asia leads global recovery trends. |

| Nifty 50 & Sensex Today – Hong Kong’s Hang Seng | Nifty 50 & Sensex Today follow a similar bullish tone after Hang Seng gained over 2%. | Impact on the Indian Market | Market experts see continued momentum in Asian markets amid easing policies. | Adds strength to Indian IT and financial stocks due to improved global liquidity. |

| Nifty 50 & Sensex Today – China’s Shanghai Composite | Nifty 50 & Sensex Today rise alongside China’s Shanghai Composite, which moved up 1%. | Stronger-than-expected Q3 GDP growth of 1.1% and industrial output up 6.5%. | Analysts note China’s steady recovery supports the entire Asia-Pacific sentiment. | Enhances market stability and commodity demand outlook, benefiting Indian exporters. |

| Nifty 50 & Sensex Today – US Dow Jones & Nasdaq | Nifty 50 & Sensex Today gain support from Wall Street’s positive close last week. | Easing inflation, solid corporate earnings, and optimism about Fed rate cuts. | US indices continue to set a global bullish tone ahead of policy decisions. | Encourages FII participation and improves market breadth in India. |

| Nifty 50 & Sensex Today – European Markets (FTSE, DAX, CAC 40) | Nifty 50 & Sensex Today stay upbeat as European indices trade higher on improved business sentiment. | Eurozone inflation moderates while energy prices remain stable. | Economists see signs of steady growth in Europe post-recession fears. | Strengthens risk-on sentiment globally, supporting cyclical sectors in India. |

| Nifty 50 & Sensex Today – Crude Oil Market | Nifty 50 & Sensex Today benefit from stable crude oil prices below $85 per barrel. | Balanced supply-demand outlook amid global production cuts and weaker demand. | Analysts predict crude may stay range-bound, easing inflation concerns. | Helps India’s import bill and supports sectors like FMCG, logistics, and paints. |

| Nifty 50 & Sensex Today – Gold Prices | Nifty 50 & Sensex Today remain unaffected as gold trades steady near $2,350 per ounce. | Weak US dollar and expectations of Fed rate cuts boost gold prices. | Experts suggest gold remains a safe hedge amid global uncertainties. | Indicates investor preference shifting toward equities during the festive rally. |

| Nifty 50 & Sensex Today – Silver & Industrial Metals | Nifty 50 & Sensex Today gain indirectly as silver and copper prices rise globally. | Renewed demand from manufacturing and renewable energy sectors. | Analysts see rising metals demand as a signal of global economic strength. | Supports India’s metal and mining sector stocks, adding to market momentum. |

| Nifty 50 & Sensex Today – US Dollar Index (DXY) | Nifty 50 & Sensex Today get a lift as the US Dollar Index weakens slightly below 104. | Anticipation of rate cuts by the US Federal Reserve softens the dollar. | Economists view a softer dollar as positive for emerging market currencies. | Boosts FII flows into India and improves rupee stability, lifting sentiment. |

| Nifty 50 & Sensex Today – Global Bond Yields | Nifty 50 & Sensex Today reflect improved liquidity as global bond yields fall. | Rate cut expectations reduce yields on US and EU bonds. | Analysts say lower yields make equities more attractive globally. | Supports valuation expansion in Indian large-cap and mid-cap stocks. |

| Nifty 50 & Sensex Today – Cryptocurrency Market | Nifty 50 & Sensex Today mirror global risk-on mood as Bitcoin crosses $70,000 again. | Renewed optimism in digital assets as regulations ease in key economies. | Crypto rally shows rising risk appetite among investors. | Encourages retail investor participation and sentiment spillover to equities. |

| Nifty 50 & Sensex Today – Commodity Basket Outlook | Nifty 50 & Sensex Today gain from a balanced commodity market across energy and metals. | Stable commodity prices maintain inflation control and business cost efficiency. | Economists expect steady commodity demand through Q4 2025. | Keeps India’s CPI inflation low, supporting RBI’s accommodative policy stance. |

Nifty 50 & Sensex Today are not just responding to domestic earnings and investor optimism but also drawing strength from a globally positive setup. Asian equities, US indices, and commodities are all in sync with a pro-growth environment, creating the perfect setup for a Diwali 2025 rally. With crude stable, gold shining, and the dollar weakening, India’s markets are positioned to maintain their bullish trend as festive optimism fuels the economy.

Outlook: Holiday Cheer Keeps the Market Up

With the Nifty 50 near 26,000 and the Sensex close to 85,000, the Indian stock market looks ready for a holiday rally, thanks to good news from around the world, strong earnings, and institutions constantly buying. Experts think that having solid basics, foreign investors coming back, and expectations of lower interest rates will keep pushing the market up.

As Diwali 2025 gets closer, good feelings and confidence are lighting up Dalal Street, showing that the bulls are in charge and the Indian economy is still strong.

Note: All information and images used in this content are sourced from Google. They are used here for informational and illustrative purposes only.

FAQs: Nifty 50 Near 26,000 & Sensex Today Before Diwali 2025

1. What’s driving the Nifty 50 near 26,000 and Sensex close to 85,000 ahead of Diwali 2025?

The main reason behind this festive rally is strong global cues, robust quarterly earnings, renewed buying from foreign investors, and hopes of rate cuts by the US Fed and RBI. Together, these factors have boosted market sentiment and attracted fresh investment inflows.

2. How did the Nifty 50 and Sensex perform in the last trading session?

On Friday, the Sensex jumped 484.53 points (0.58%) to close at 83,952.19, while the Nifty 50 gained 124.55 points (0.49%) to settle at 25,709.85 — marking the third straight session of gains.

3. What are the key support and resistance levels for the Sensex today?

Experts expect the Sensex to find strong support near 83,000–82,400, while resistance is likely around 84,400–85,300. If it stays above 83,000, the bullish momentum could push it toward 85,000 soon.

4. What’s the Nifty 50 prediction for October 20, 2025?

The Nifty 50 is showing a decisive breakout above the 25,400–25,500 resistance zone. The next upside targets are 26,000–26,200, with strong support around 25,400–25,500. If it maintains momentum, analysts see potential for 26,300–26,730 in the medium term.

5. Why is the Bank Nifty showing strong momentum right now?

The Bank Nifty is in a clear uptrend, supported by bullish technical indicators like a rising RSI (above 74) and positive MACD. It’s currently trading above its key moving averages, with support near 57,300–57,400 and possible upside toward 58,500–59,000. Experts recommend a buy-on-dips strategy during this festive period.

6. How are global markets influencing India’s stock market rally?

Asian markets are performing well — Japan’s Nikkei surged 3%, Hong Kong’s Hang Seng rose 2%, and China’s Shanghai Composite climbed 1%. Positive global momentum and steady economic growth in Asia have strengthened investor confidence in emerging markets like India.

7. What role do Q2 earnings play in the current market rally?

Stable Q2 earnings from large-cap companies such as Reliance Industries, HDFC Bank, and Infosys have reinforced optimism. Investors view these steady results as proof of India’s economic resilience, supporting continued market gains ahead of Diwali.

8. Are foreign investors (FIIs) buying Indian stocks again?

Yes, foreign institutional investors (FIIs) have turned net buyers after a cautious phase. Combined with strong domestic institutional investor (DII) activity, this renewed interest has given the market extra strength and stability.

9. Will interest rate cuts by the Fed and RBI impact the stock market?

Analysts expect two Fed rate cuts by the end of 2025, along with a possible RBI rate cut to 5.25%, given low inflation. Lower rates make borrowing cheaper, attract foreign capital, and generally lift stock market performance — all positive for Indian equities.

10. What’s the overall outlook for Nifty 50 and Sensex before Diwali 2025?

With Nifty 50 near 26,000 and Sensex near 85,000, the outlook remains bullish. Experts see more upside ahead, supported by festive demand, strong fundamentals, and improving global sentiment. The bulls clearly have control, and new highs may not be far away.